Historically, institutional investors kept their investing strategies and their activities very discreet. Today, however, some are aggressively employing social media tools to discuss their strategies, deals in the pipeline, and even their political views and sporting accomplishments. Currently, the share of asset managers present on social media currently stands at 89% (73% excluding LinkedIn), up from 60% in 2013.

According to the PWC Research Centre, “Social media channels are not just additional channels to deliver corporate messages to a diverse global audience; they are also a pool of valuable information and insights. Social media is among the favourite channels to discover and monitor opinions on products, services and companies, particularly among Millennials, which will soon represent the new wave of investors. Thus, mining social channels, with the use of sophisticated analytic tools brought to life by technological advancements, could be a valuable option for asset managers. The adoption of “social listening” tools could help them streamline their product development practices according to customers’ changing needs.”

So why Capitalize on Social Media?

Many investors remain ambivalent about social media because the advantages of using it are not always apparent, but the detractions can be very clear. Private equity investing is a relationship business. As more of our personal relationships move online, social media becomes a very cost-effective way to strengthen a firm’s corporate relationships.

“Social media could also represent a new distribution channel for asset managers looking at reaching retail investors and facilitating the subscriptions to funds. This could unlock new fund-related revenues and broaden asset managers’ potential customer bases. In addition, as investors are becoming accustomed to expecting from FS providers the same level of speed, personalisation and simplicity offered by technology firms like Google and Amazon, creating social media accounts dedicated solely to customer services issues could enhance the customer experience. At the same time, the creation of corporate accounts on social media networks for investment firm employees that deal with client portfolios on a daily basis could also help meet clients’ needs, as is the case for other industries such as technology and consumer goods.”

We did some research to establish what the current global digital landscape looks like when it comes to the utilization of digital and social media across investment and asset management firms and the following are the 3 key take outs from the exercise:

a) Preferred Platforms for Asset Managers

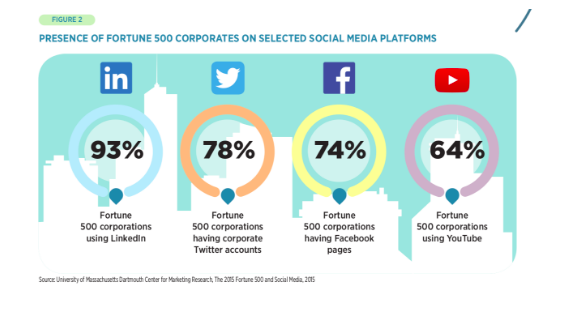

The figure below shows the preferred social media channels by Fortune 500 companies, an important metric for Asset Management firms that seek to reach investors from this pool. LinkedIn has, over the years, remained the leading social media platform of choice among Asset Management Firms worldwide because of its business minded audience, job and digital advertising opportunities and content that ranges from industry based discussions to white papers and business case studies.

b) Main Topics posted by Asset Management Companies online per Platform

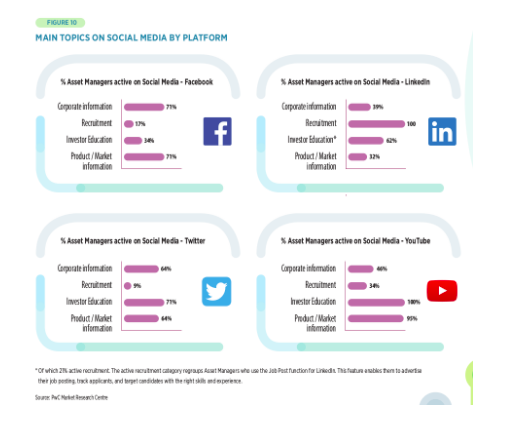

Through this research, we discovered that the socially-active asset management companies have a bias for specific content depending on the platform being utilized. This means there has to be a deliberate effort to integrate, within the content plan, a bias for each respective social media messaging content based on the platform and audience that consumes the content.

c) What are the Top 50 Asset Management Firms on Social Media

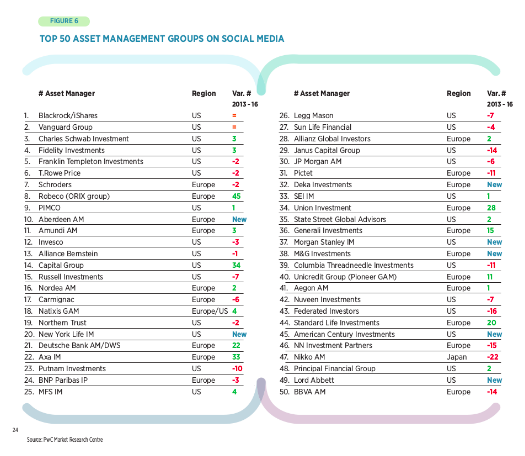

It is crucial to note that the largest Asset Management firms in the world are utilizing social media and have been using it over the last 4 years. Below is a comprehensive list of the leading asset management firms on Social Media.

Interactions with their platforms revealed a lot about why and how each of these entities utilize digital media within their organizations. This can be summarized into four key areas as follows:

- Sharing Corporate Information

- Investor Education

- Product or Market Information

- Recruitment

Every asset management firm must strive to understand how it should utilize social media to advance its core business. This comprises an intimate understanding of the audience, an appreciation for the tone of each channel to ensure that the right content is pushed through the right channels, and ultimately message clarity in their overall communication objectives. Therefore, for an investment and asset management organization to succeed in the digital and social media space, it must emulate the best case studies and learn from the mistakes of others.

The strategic approach to utilization of social media should not only cover both but also go further to capture the essence of the organization and what the organization’s brand stands for. Integrating these traits will enable the organization to define and curve out its niche and make it a future case study for other asset management firms.